A collection agency licensed in Alabama can collect both consumer and and commercial debts in the state. CA-USA is a highly rated collection agency serving medical practices, businesses and government institutions all across United States.

Contact us for a free consultation regarding our services.

Consumer Collection Laws (B2C or Individual collections)

Communication and Conduct of Debt Collectors

- Debt collectors in Alabama are required to follow strict guidelines regarding how and when they can contact debtors. If a debtor requests in writing that a debt collector stop contacting them, the collector must comply, except to notify the debtor of specific actions like lawsuits.

- Collectors can contact others to find out the debtor’s address or workplace but are generally prohibited from disclosing the debtor’s debts to third parties and from contacting these third parties more than once.

- Debt collectors must send a letter to the debtor within five days of the first contact, stating the amount owed, the creditor’s name, and the actions that will be taken if the debt is not paid.

Prohibited Practices

- Threats of violence, publishing lists of debtors, excessive contact meant to annoy, and falsely representing oneself as an attorney or government representative are among the practices banned under Alabama law and the Fair Debt Collection Practices Act (FDCPA).

- Additionally, debt collectors cannot misrepresent the amount owed or threaten actions that are illegal or that they do not intend to take.

Garnishment and Levies

- Alabama follows federal rules for wage garnishment, allowing up to 25% of a worker’s wages to be garnished. However, certain types of funds, including 401k and other retirement funds, are generally exempt from garnishment.

- Creditors in Alabama can levy bank accounts as part of the debt collection process, but specific procedures and exemptions apply, particularly regarding the types of funds that can be levied.

Statute of Limitations and Consumer Rights

- The statute of limitations for collecting debts in Alabama varies by the type of debt: 3 years for open accounts (including credit cards), 6 or 10 years for written contracts, and 6 years for oral contracts.

- Consumers have the right to request debt validation within 30 days of the first contact, during which time the collector must cease collection activities and prove the debt’s legitimacy.

Penalties and Consumer Protections

- Violations of debt collection laws in Alabama can result in civil liability, state fines and penalties, licensing discipline, and intervention by the Consumer Financial Protection Bureau (CFPB).

- Recent changes in Alabama law include increased bonding requirements for collection agencies and additional licensing requirements to enhance consumer protection.

It’s important for consumers to understand their rights under Alabama’s debt collection laws to protect themselves against unfair or abusive collection practices. If you believe a debt collector is violating these laws, you can file a complaint with the Alabama State Banking Department or the Consumer Financial Protection Bureau.

Commercial Collection Laws (B2B or Business collections)

In Alabama, the process and practices around B2B (Business-to-Business) collections can significantly differ from consumer debt collections. B2B collections are not governed by the Fair Debt Collection Practices Act (FDCPA), which primarily covers consumer collections. This difference allows for more flexibility in how businesses can pursue unpaid invoices from other businesses.

Key aspects of the B2B collections process involve understanding the distinct nature of commercial relationships, which are generally more complex and involve larger invoice amounts and longer sales cycles compared to B2C (Business-to-Consumer) transactions. In B2B settings, relationships are key, and the collections process must be handled in a way that maintains these important relationships while effectively recovering owed amounts.

Best practices in B2B collections include:

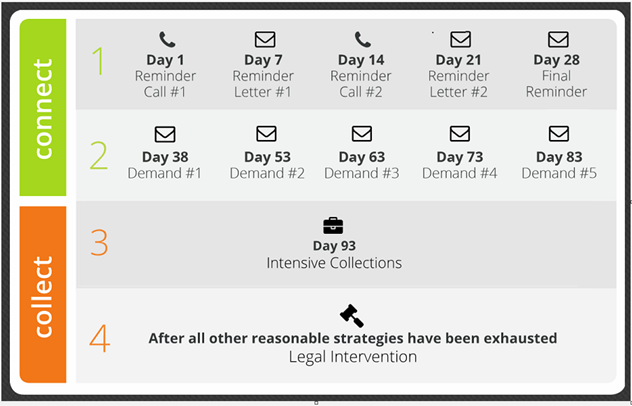

- Clear Communication: Initially, a reminder or invoice is sent as a friendly nudge to the debtor. This step is crucial for maintaining good relationships and opens the door for any disputes or discussions about the invoice.

- Follow-Up: If payment is not received, following up with additional reminders or phone calls is necessary. This persistence shows the importance of settling the outstanding balance.

- Negotiation: Understanding that businesses may face genuine cash flow issues, offering a negotiation for a payment plan or settlement can be beneficial.

- Legal Action: As a last resort, considering legal action or handing the debt over to a collection agency can be necessary steps. This is often considered when other attempts have failed and requires careful consideration of the impact on the business relationship.

- Use of Collection Agencies: Engaging a B2B collection agency can be a strategic move to recover debt without harming the business relationship. These agencies specialize in commercial collections and understand the delicacy of B2B relationships.

Improving your B2B collections process involves clear payment terms, accurate and prompt invoicing, systematic follow-ups on overdue payments, flexible payment options, and maintaining strong customer relationships.