Main Content

CA-USA Credit & Debt Collection Agency

Why Businesses and Doctors select us?

Our Online Ratings

We are the highest-rated credit collection agency, with nearly half of our reviews coming directly from the individuals we assist. They’re often surprised by how easy and respectful the process is. Our collaborative approach ensures not only high recovery rates but also protects your valuable reputation. Our BBB rating is A+.

We’ve got you covered

Licensed, bonded, and insured in all 50 states and Puerto Rico, we are fully compliant with all the Federal and State laws including FDCPA, HIPAA, GLBA, TCPA, and SSAE 18 SOC 1 Type 2 data security standards. Our bilingual teams offer expertise in both English and Spanish, providing effective credit collection services for both commercial and consumer accounts.

OUR GUARANTEE: We promise to minimally collect 2 times your purchase price if all accounts purchased under our agreement are entered and processed through our Connect phase as instructed by our representative, or we will refund the entire purchase price or the difference, if any, between what was collected in Connect and twice what was paid to use for the Connect service.

Need a Credit Collection Agency? |

|

|

|

|

Success Rate and Fees:

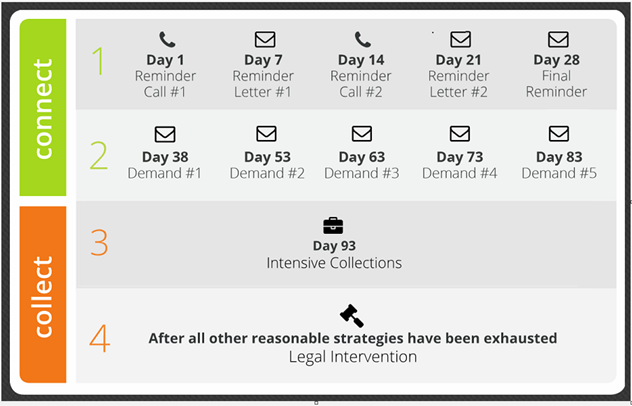

Our recovery rates significantly surpass those of the average credit collection agency. We offer a comprehensive, cost-effective solution with tiered services:

- Fixed-Fee Pre-Collections: A proactive approach to minimize bad debt with five first-party notices and calls. Account is technically not in collections yet. Debtor is given a final chance to pay, else his account will be forwarded to our collection agency, Step (2) or (3).

- Fixed-Fee Third-Party Collections: Escalated recovery efforts with five collection demands sent on Collection Agency’s letter head. Debtor is far more likely to pay because now a collection agency is officially involved. Step (1) and (2) are usually tax-deductible as a business expense.

- Contingency-Fee Third-Party Collections: A performance-based option for difficult and older accounts. No recovery means No-fee.

- Legal Collections: A last resort, reserved for the most challenging cases.

Contact us, and we will guide you which service is the best for you. Our services also include complimentary bankruptcy screening, credit bureau reporting, change of address verification, and litigious debtor checks. There are no onboarding or hidden fees associated with our credit collection services.

Technology and Resources

We are a modern collection agency, equipped with the latest tools and technology to streamline the recovery process for faster, better results. Our user-friendly online client portal makes submitting, managing, and tracking your accounts as easy as online banking. We’re committed to excellence, hiring only the most experienced and skilled debt collectors in the industry.

Communication and Transparency

Open communication is essential to a successful partnership. At CA-USA, we prioritize clear and consistent dialogue. Your dedicated Account Representative is always available to address your questions or provide training on our client portal.

Difference between Debt and Credit Collection Agency:

A debt collection agency collects different types of unpaid bills. These can be anything from medical bills, utility bills, etc.

A credit collection agency mainly focuses on collecting unpaid debts that come from credit accounts, like credit cards or loans.

Recent Posts

- Texas Businesses: 9-Step Playbook for Hiring a Compliant Collection Agency

- What HVAC Businesses Need to Know About Hiring a Collection Agency

- Is It Ethical for Medical Practices to Hire a Collection Agency

- Collection Agency in Indiana

- 20 Essential Tips for Doctors Hiring a Medical Office Administrator

- Hiring a Collection Agency vs. Recovering Debt Yourself: Which is the Better Choice?

- Expert Guide to Finding the Perfect Collection Agency

- How a Collections Agency Drives Results: A Case Study

- Hire a Local Collection Agency in Ohio

- Collection Agency You Can Trust: 4.9/5 Customer Rating

- Illinois Debt Collection Agency – Proven Results

- Debt Recovery Services in Arizona: Collection Agency

- The Hidden Costs of Uncollected Debt: Is Your Business Bleeding Profits?

- Will a Collection Agency Recover ALL My Debt? The Reality

- Collection Agencies: Are Cheap Fees Putting Your Business at Risk?

- Strategic B2B Debt Recovery: Balancing Efficiency and Relationships

- Debt Recovery Services in Alabama: Collection Agency

- Commercial Business Rent Collection Agency

- Debt Recovery Services in New Jersey: Collection Agency

- 7 Realities of Suing a Client for Non-payment

- Pre-Collection Services: A Gentle Approach to Debt Recovery

- Frequently Asked Questions About Commercial Collections

- Why is it Worth Investing in Collection Services?

- Debt Recovery for Snow Removal Companies

- 15 Expectations for Medical Practices from a Collection Agency

- The Hidden Costs of Uncollected Debt: Is Your Business Bleeding Profits?

- Why is it Worth Investing in Collection Services?

- Why College Debt is Gold for Collection Agencies?

- Healthcare & Medical Bill Collection Agency: Serving Nationwide

- Is It Ethical for Medical Practices to Hire a Collection Agency

- Are there Benefits of Hiring a Collection Agency Near Me?

- Will a Collection Agency Recover ALL My Debt? The Reality

- Dental Bill Collection Agency: Serving Nationwide

- Debt Recovery for Snow Removal Companies

- How to hire a Commercial Collection Agency in New York?

- Collection Agencies: Are Cheap Fees Putting Your Business at Risk?

- Strategic B2B Debt Recovery: Balancing Efficiency and Relationships

- Collection Agency You Can Trust: 4.9/5 Customer Rating

- Commercial Collection Agency: Serving Nationwide

- How a Collections Agency Drives Results: A Case Study

- 20 Reasons Utility Companies Love CA-USA Collection Agency

- Hire a Local Collection Agency in Ohio

- Commercial Business Rent Collection Agency

- Texas Businesses: 9-Step Playbook for Hiring a Compliant Collection Agency

- Collection Agency Integration for Athenahealth: Get Higher Recovery

- Collection Agency in Indiana

- Debt Recovery Services in California: Collection Agency

- Debt Recovery Services in Texas: Collection Agency

Featured Posts

- Collection Agency Integration for Athenahealth: Get Higher Recovery

- Cost Management and Collections for Credit Unions

- Why College Debt is Gold for Collection Agencies?

- Are there Benefits of Hiring a Collection Agency Near Me?

- Small Business Collection Agency: Serving Nationwide

- Commercial Collection Agency: Serving Nationwide

- Dental Bill Collection Agency: Serving Nationwide

- Debt Recovery Services in Florida: Collection Agency

- Debt Recovery Services in Texas: Collection Agency

- Healthcare & Medical Bill Collection Agency: Serving Nationwide

- Debt Recovery Services in California: Collection Agency

We have been assisting thousands of businesses & medical practices across the country. We are an authorized business development partner at a prominent and a highly rated collection agency. BiotechArticles.com itself is not a debt collection agency. All ratings, information and product details refer to our partner agency. All inquiries are handled personally by our team along with the partner agency who have over 20 years of experience in the collections industry.

.