CPAs Don’t Need Another Vendor — You Need a Recovery Partner That Protects Your Client Relationships

You already do the hard part: keeping books clean, cash flow predictable, and businesses compliant.

But when receivables age out, even the best financial reporting can’t turn an unpaid invoice into usable working capital. That’s where CA-USA steps in—professionally, quietly, and with results your clients can feel.

Protecting your office reputation, CA-USA holds licenses in all 50 states, ensuring a safe approach during every interaction. We provide free litigation and bankruptcy scrubs with zero onboarding or annual fees. Our SOC 2 Type II compliant systems ensure total data security, backed by a 4.85/5 rating from over 2,000 professional reviews. Delivering high recovery rates!

Need a Collection Agency? Contact us

Built for CPAs: Firm on Results, Fair on People

CA-USA is an Account Reconciliation Team, not a “pressure-first” collections shop. Our job is to resolve outstanding accounts in a way that protects brand reputation, preserves relationships, and helps your clients stabilize cash flow without internal chaos.

We currently support 200+ CPAs nationwide—because accountants need a partner who understands how sensitive client relationships are. When a CPA refers a recovery provider, it reflects on the firm. We treat that trust like an asset.

Why CPA Firms Refer CA-USA (And Keep Referring)

When your client has aging AR, they usually face one of two choices:

1) Keep chasing internally (burning employee time, adding stress, producing inconsistent results)

2) Escalate too aggressively (damaging customer relationships and creating reputation risk)

CA-USA is the middle path done correctly: professional mediation + structured pressure + clean documentation.

You don’t want drama. You want closure.

Performance-Based Recovery

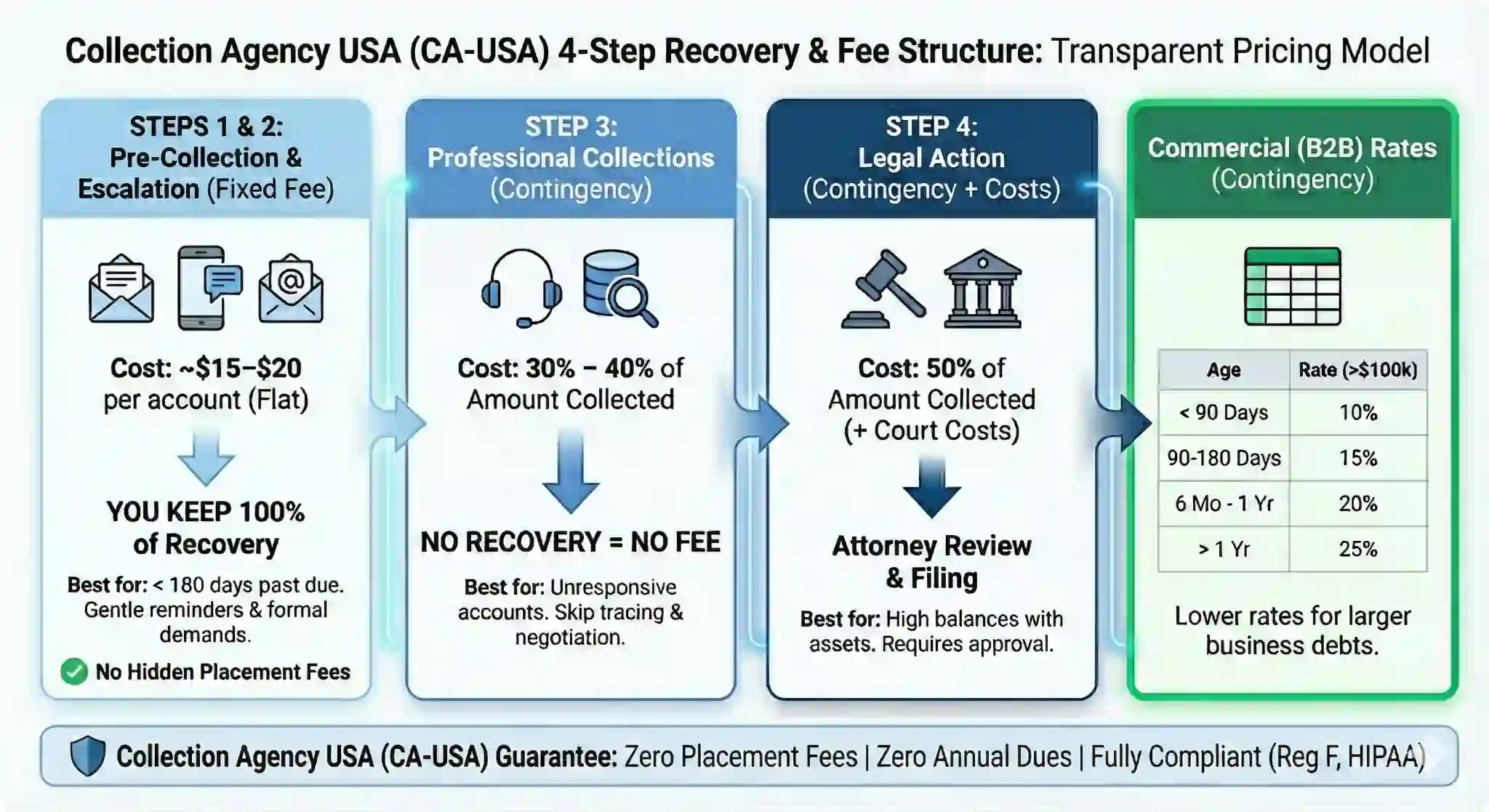

CA-USA gives two clean lanes:

-

Fixed-Fee: $15 per account (you keep 100% of what’s recovered)

-

Contingency: 40% (no recovery, no fee)

How We Protect Your Client’s Brand (And Your Reputation)

Most accounts resolve without court involvement. That’s intentional.

We prioritize relationship preservation using cooperative mediation:

-

Calm outreach

-

Clear documentation

-

Direct negotiation with decision-makers

-

Structured payment solutions that feel fair and final

The objective isn’t punishment. It’s payment.

The CA-USA Workflow (What You Can Tell Clients With Confidence)

1) Contract & Invoice Intelligence

We gather the paperwork that wins disputes: invoices, signed agreements, POs, delivery proof, service records, emails, and payment history. We also verify business identity and contact pathways.

2) Formal Notice + Multi-Channel Launch

A clean demand notice is sent immediately, backed by documentation. We use multiple channels to avoid “wrong department limbo” and speed up response.

3) Human-to-Human Negotiation

No robo-calls. We reach controllers, CFOs, owners, and AP managers directly. We isolate the real reason for non-payment—dispute, approval delay, cash timing, or vendor dissatisfaction—and convert it into a firm resolution path.

4) Deep-Dive Verification

If an account gets evasive, we apply practical tools: USPS address verification, skip tracing, and bankruptcy screening. We also run a Litigation Scrub to identify high-risk cases early.

5) Credit Reporting + Pre-Legal Escalation

Where permitted, we offer Credit Reporting to Business Credit Bureaus, including:

Dun & Bradstreet, Experian Business, and Equifax Commercial

This is a powerful non-legal lever that often produces results without ever stepping into court.

6) Final Lever: Legal Escalation (with your permission only)

If the customer refuses to resolve and the file supports it, we can initiate legal action using our nationwide attorney network—followed by judgment enforcement when appropriate.

Accountants Appreciate This: We Reduce “Hidden Costs”

Aging AR is more than a missing payment. It’s the hidden burn:

-

Staff time spent chasing

-

Owners distracted from sales and service

-

Uncertainty in cash planning

-

Bad debt that keeps growing quietly

When CA-USA takes over the recovery process, your client regains time and control. You regain cleaner forecasting. Everybody wins.

Quality Controls That Prevent Blowback

Collections failures usually come from sloppy behavior. We guard against that.

-

Calls are recorded and reviewed for quality assurance

-

We use structured messaging to avoid reputational harm

-

We keep communications professional and documented

-

We avoid “rogue collector” behavior that causes review-bombing or public escalation

This is exactly why CPA firms stick with us. The risk profile is managed.

CPA-Focused FAQs

Will this damage my client’s customer relationships?

In most cases, no. Our mediation-first approach is designed to preserve the relationship while still producing payment.

When should a client assign an account?

Early. Under 200 days is the strongest recovery window. The older it gets, the more the leverage shifts away from your client.

Do you help with documentation when accounts are disputed?

Yes. We reconcile the timeline, isolate the objection, and push toward written resolution—settlement, payment schedule, or final closeout.