When faced with unpaid debts, business owners often grapple with whether to handle the recovery themselves or hire a collection agency. Both approaches have their merits and drawbacks. This comparative analysis will help you determine the best course of action based on your specific situation.

Hiring a Collection Agency

Advantages:

- Expertise and Resources: Collection agencies are specialists in debt recovery, equipped with advanced tools and strategies that can increase the likelihood of successful collection. Their knowledge of the industry, combined with access to sophisticated resources, ensures that they can locate debtors, assess their financial situation, and negotiate effectively.

- Enhanced Recovery Efforts: Agencies use a variety of techniques, such as skip tracing to locate debtors, credit bureau reporting, and monitoring bankruptcy filings. These methods are typically included in their services, saving you the considerable cost and effort of managing these tasks independently.

- Time-Saving: Debt collection is a time-consuming process. By outsourcing it to a professional agency, you can redirect your time and resources toward growing your business, ensuring that your operations remain uninterrupted.

- Legal Compliance: The debt collection landscape is fraught with legal complexities. Collection agencies are well-versed in the relevant laws and regulations, reducing the risk of inadvertently violating the Fair Debt Collection Practices Act (FDCPA) or other regulations, which could lead to legal consequences.

- Improved Success Rate: With their persistent and professional approach, collection agencies typically achieve higher recovery rates. Their ability to escalate the matter and employ various negotiation tactics often leads to quicker and more successful outcomes.

- Increased Likelihood of Settlement: The involvement of a collection agency often signals to debtors that the situation is serious, prompting them to settle their debts more swiftly to avoid further consequences.

- Reduced Stress and Conflict: Debt recovery can be stressful and lead to confrontational situations. By delegating this task to an agency, you avoid direct interactions with debtors, minimizing stress and potential conflicts.

- Access to Legal Action: If amicable recovery efforts fail, collection agencies can initiate legal proceedings on your behalf, providing an additional layer of pressure on the debtor and increasing the chances of debt recovery.

- Improved Cash Flow: Efficient debt recovery can significantly enhance your business’s cash flow, providing the liquidity needed to manage expenses and invest in growth opportunities.

- Focus on Core Business: Outsourcing collections allows you to stay focused on what you do best—running and expanding your business—while experts handle the debt recovery process.

- Deterrent Effect: The mere knowledge that you employ collection agencies can act as a deterrent, encouraging customers to pay on time to avoid the involvement of a third party.

- Flexibility: Collection agencies can handle a wide range of debts, whether large or small, offering scalability that aligns with your business’s unique needs.

- Objectivity: Agencies approach debt collection with an objective perspective, free from the emotional attachment or personal biases that might cloud your judgment.

- Customized Fee Structures: Many collection agencies offer flexible fee structures, such as fixed-fee services for newer accounts and contingency fees for older, more challenging debts. This allows you to tailor the cost of recovery to the specific circumstances, making the process more cost-effective.

- Skip Tracing and Advanced Technologies: Agencies often have access to sophisticated technologies, like skip tracing, that allow them to locate debtors who have moved or changed contact information. This level of access is typically beyond the reach of most businesses, ensuring that even elusive debtors can be tracked down and held accountable.

Disadvantages:

- Cost: While effective, collection agencies charge fees, usually a percentage of the recovered amount. This cost needs to be weighed against the potential benefits of a higher recovery rate.

- Loss of Control: By outsourcing, you relinquish direct control over the collection process, including how the agency communicates with your debtor.

- Potential Impact on Reputation: Although reputable agencies follow ethical practices, there’s always a risk that aggressive tactics could harm your business’s reputation. It’s essential to choose an agency known for its professionalism and adherence to ethical standards.

Recovering Debt Yourself

Advantages:

- Cost Savings: By managing debt recovery in-house, you avoid agency fees, potentially maximizing your net recovery.

- Maintaining Control: Handling collections yourself allows you to control the narrative and tailor your communication to the debtor, which might be advantageous in preserving customer relationships.

- Preserving Relationships: A personalized, empathetic approach may help maintain positive relationships with customers, especially if the debt arose from temporary financial difficulties.

Disadvantages:

- Time-Consuming: Effective debt recovery requires significant time and effort, which can detract from your primary business responsibilities.

- Limited Resources: Without specialized tools and legal knowledge, your efforts may be less effective, resulting in lower recovery rates.

- Lower Success Rate: The absence of professional expertise and persistent follow-up could result in fewer successful recoveries.

- Emotional Stress: Engaging directly with uncooperative debtors can be emotionally draining, potentially affecting your well-being and business focus.

Factors to Consider When Making Your Decision

- Age of the Debt: Older debts are more challenging to collect. A collection agency’s expertise becomes increasingly valuable as time passes.

- Amount of Debt: For larger debts, the potential recovery via an agency might justify their fees, while smaller debts might be more manageable in-house.

- Debtor’s Willingness to Pay: A cooperative debtor may respond well to self-recovery efforts, but an unresponsive one might necessitate professional intervention.

- Your Resources and Expertise: Consider whether you have the necessary time, tools, and knowledge to effectively pursue the debt on your own.

- Relationship with the Debtor: If maintaining a positive relationship is crucial, a direct, personalized approach may be preferable, though it requires careful balancing with the challenges involved.

- Cost-Effectiveness: Consider using fixed-fee services for newer accounts, where the likelihood of recovery is higher, and reserve contingency fee arrangements for older, more difficult debts. This approach can optimize your collection costs while ensuring effective recovery efforts.

Recommendations

- Start with Self-Recovery: If the debt is recent, manageable in size, and the debtor is cooperative, initiate the recovery process yourself. Ensure your communication is professional and persistent.

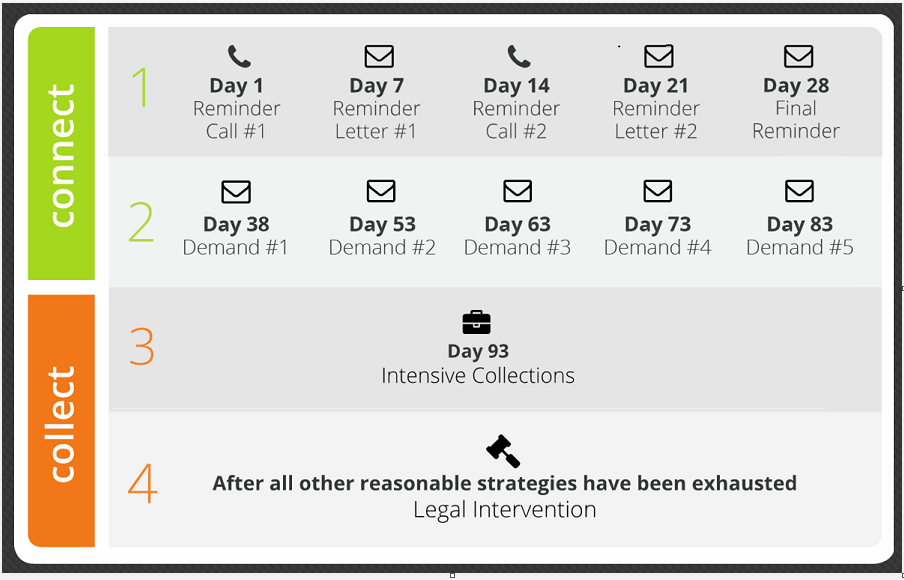

- Consider Hiring a Collection Agency: If your efforts are unsuccessful, the debt is old or substantial, or the debtor is unresponsive, engaging a reputable collection agency is advisable.

- Choose Your Agency Carefully: Conduct thorough research to select an agency with a strong track record, transparent fee structure, and commitment to ethical practices.

- Utilize Cost-Effective Strategies: For newer debts, consider a fixed-fee service to keep costs down while maintaining high recovery rates. For older, more challenging debts, a contingency fee arrangement can be more effective, as it aligns the agency’s incentive with your recovery goals.

Ultimately, the best approach depends on your specific circumstances. Consider the pros and cons of each option, taking into account factors such as the debt’s age and amount, the debtor’s responsiveness, your available resources, and the importance of maintaining relationships. If in doubt, seek advice from a financial advisor or legal expert specializing in debt recovery to guide your decision.