In Arizona, as elsewhere in the United States, consumer debt collection is primarily governed by the Fair Debt Collection Practices Act (FDCPA). This federal law sets high standards to protect consumers from abusive, deceptive, and unfair debt collection practices. For creditors and their agents, strict adherence to the FDCPA is non-negotiable. Violations can result in significant legal penalties and harm to your business’s reputation.

Need a highly rated collection agency? Contact us |

Beyond the FDCPA, the Arizona Revised Statutes Title 32, Chapter 10 introduces additional regulations specific to debt collectors in the state. These include mandatory licensing for collection agencies and a prohibition on certain aggressive collection practices. It’s crucial for businesses operating in Arizona to understand these local requirements to ensure compliance.

One of the FDCPA’s key protections for consumers is their right to dispute a debt within 30 days of the first contact by a debt collector. During this period, collection efforts must be paused until the debt is verified. This underscores the importance of maintaining comprehensive records on the debts you are attempting to collect.

Moreover, the FDCPA imposes restrictions on communications. Collectors are prohibited from contacting debtors at inconvenient times or places and must cease communication upon request, with limited exceptions. These provisions aim to balance the collection efforts with respect for the debtor’s privacy and well-being.

Commercial Debt Recovery in Arizona

When it comes to commercial debt (debt incurred for business purposes), the regulatory landscape is less stringent than for consumer debt. The FDCPA does not apply to commercial debt collection, offering creditors more flexibility in their collection strategies. However, principles of fairness and the prohibition of deceptive practices still apply under general contract law and other relevant statutes.

The Uniform Commercial Code (UCC), adopted in part by Arizona, lays down uniform rules for commercial transactions, including the sale of goods and the assignment of debts. Understanding the UCC can help creditors navigate the complexities of commercial debt recovery, from contract formation to the enforcement of agreements.

Arizona’s contract law further governs the enforceability of agreements and what happens when a party breaches a contract. Creditors should ensure that all agreements are clearly documented, legally sound, and enforceable under Arizona law.

- Commercial Credit Bureaus: Businesses have dedicated credit reporting agencies such as:

- Dun & Bradstreet

- Experian Business

- Equifax Business

- Impact on Creditworthiness: Late payments and delinquent commercial debts can significantly damage a business’s credit score. This can make it harder to obtain future loans, secure favorable terms, or get approved for insurance.

Additional Legal Considerations in Arizona

- Statute of Limitations: It’s critical to initiate collection efforts within the legally prescribed timeframe, which varies by the type of debt. Failure to do so may result in the loss of legal recourse.

Written contracts: 6 years

Oral contracts: 3 years

Open accounts: 3 years - Interest Rates: While interest on overdue debts can incentivize timely payment, Arizona caps the rates that can be charged, especially for consumer debts.

- Wage Garnishment: Arizona law limits how much of a debtor’s wages can be garnished, providing protections for consumers while allowing creditors to recover owed amounts.

Strategic and Ethical Considerations for Creditors

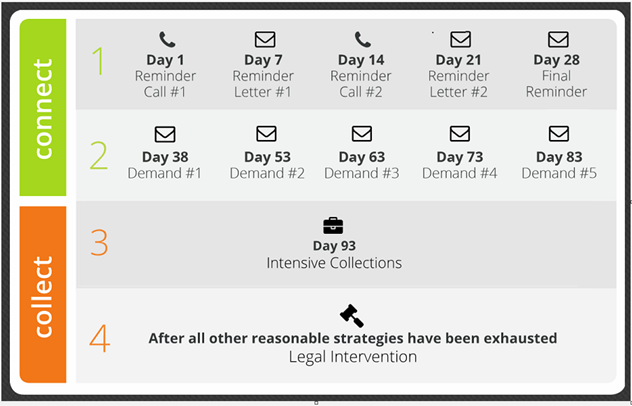

- Documentation and Early Action: Keeping detailed records and initiating contact with debtors early can improve the chances of successful debt recovery.

- Legal and Ethical Escalation: Knowing when and how to escalate collection efforts, including the use of reputable collection agencies or legal action, is key to effective debt recovery while maintaining your business’s reputation.

- Bankruptcy and Alternative Dispute Resolution: Understanding the impact of bankruptcy on collection efforts and exploring alternatives to litigation can save time and resources.

Protecting Your Reputation

Adhering to both the letter and spirit of debt collection laws and treating debtors with dignity and respect are paramount. This approach not only ensures compliance with legal standards but also protects and enhances your business’s reputation in the community.

Resources for Creditors

- Arizona Attorney General’s Office: A key resource for understanding consumer protection laws and the regulatory environment for debt collection in Arizona.

- Arizona Chamber of Commerce and Industry: Offers guidance and resources for businesses, including those related to debt recovery practices.

By integrating these additional insights and points, your article can serve as a more thorough guide for creditors navigating the complexities of debt recovery in Arizona, balancing legal compliance with ethical considerations.